The most common way to pay yourself as a director of a limited company is using a mixture of salary and dividends. Keeping your salary low minimises the amount of National Insurance you have to pay, as dividends does not attract National Insurance.

Therefore, most directors take a small salary and the remainder of their company’s profits as dividends as this is the most tax-efficient method.

What are the changes to dividends tax?

The Government believes that the way dividends were taxed before 6 April 2016 – including the dividend tax credit – was “arcane” and “complex”.

Designed at a time when Corporation Tax was far higher than it is now, the Chancellor also believes that many people now work via their own limited companies simply to save tax, i.e. ‘tax motivated incorporation’.

Clearly, the changes to dividend taxation will result in an unwelcome tax hike for most limited companies, reducing the tax benefits associated with incorporating.

The notional tax credit has been replaced with a £5,000 tax free allowance and anything above this will be taxed, but this will then depend on which Income Tax band you fall within, see below:

| Tax band | Tax rate on dividends over £5,000 |

| Basic rate (and non-taxpayers) | 7.5% |

| Higher rate | 32.5% |

| Additional rate | 38.1% |

So, now you are asking yourself, what is the most tax-efficient method to take money from my business?

Here we need to think about a few things, so we have decided to look at this using a number of scenarios.

Scenario 1A

A sole director of a limited company, with no employees.

The director takes a salary up to The National Insurance Primary Threshold (£8,060) and a dividend of £50,000.

So, what has the new dividends tax cost you, compared with last year?

- The £8,060 salary is included within the personal allowance.

- The first £2,940 of dividends is included within the personal allowance.

- The first £5,000 of dividends is included within the dividend allowance.

- The next £27,000 of dividends are taxed at 7.5% (basic rate) = £2,025.

- The remaining £15,060 dividends are taxed at 32.5% (higher rate) = £4,895.

- The total dividend tax liability is £6,920 (compared to £5,348 in 2015/16)

The additional dividend tax to pay = £1,572

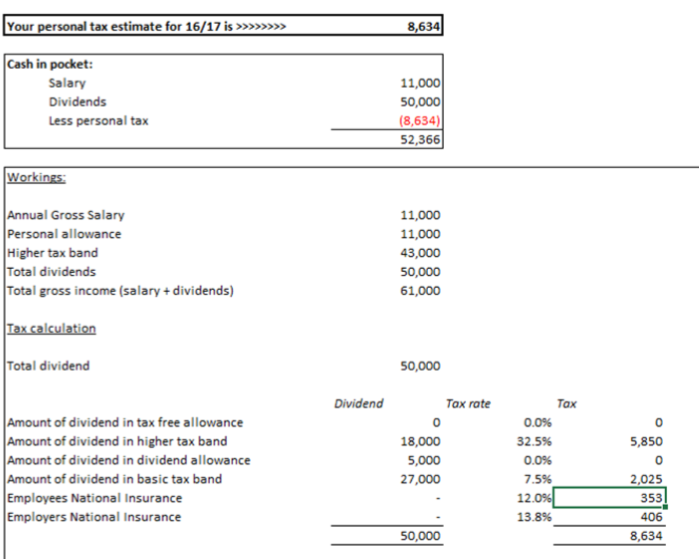

Scenario 2A

A sole director of a limited company, with no employees.

The director takes a salary up to the Personal Allowance (£11,000) and a dividend of £40,000.

Note: Because the director is the sole director and only employee, they are not eligibility for the Employment Allowance.

So, what has the new dividends tax cost you, compared with last year?

- The £11,000 salary takes up the entire personal allowance, however this employer is no eligible for the Employment Allowance and therefore Employers National Insurance is payable too.

- The first £5,000 of dividends is included within the dividend allowance.

- The next £27,000 of dividends are taxed at 7.5% (basic rate) = £2,025.

- The remaining £18,000 dividends are taxed at 32.5% (higher rate) = £5,850.

- The total dividend tax liability is £7,875 (compared to £5,348 in 2015/16)

The additional dividend tax to pay = £2,527

The additional employers allowance to pay = £406

Total additional tax = £2,933

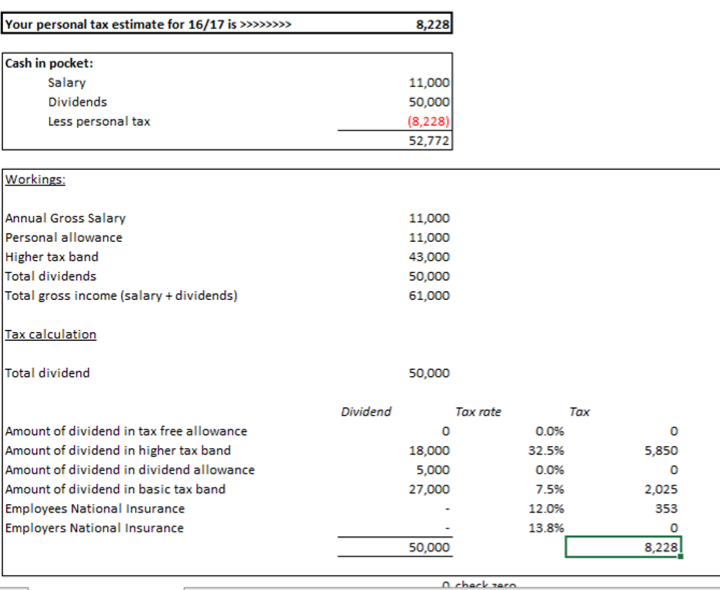

Scenario 2B

A sole director of a limited company, with 2 employees, including the director.

The director takes a salary up to the Personal Allowance (£11,000) and a dividend of £40,000.

Note: Because the director employees someone, as well as the director, they are eligibility for the Employment Allowance, therefore no Employers National Insurance is payable.

So, what has the new dividends tax cost you, compared with last year?

- The £11,000 salary takes up the entire personal allowance and this employer is eligible for Employment Allowance, so no Employers National Insurance is payable.

- The first £5,000 of dividends is included within the dividend allowance.

- The next £27,000 of dividends are taxed at 7.5% (basic rate) = £2,025.

- The remaining £18,000 dividends are taxed at 32.5% (higher rate) = £5,850.

- The total dividend tax liability is £7,875 (compared to £5,348 in 2015/16)

The additional dividend tax to pay = £2,527

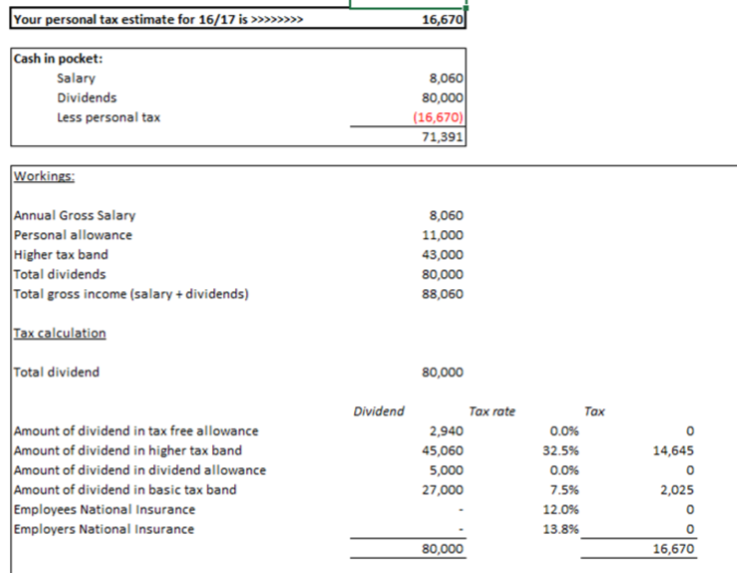

Scenario 3

A sole director of a limited company, with no employees.

The director takes a salary up to the Personal Allowance (£8,060) and a dividend of £80,000.

So, what has the new dividends tax cost you, compared with last year?

- The £8,060 salary is included within the personal allowance.

- The first £2,940 of dividends is included within the personal allowance.

- The next £5,000 of dividends is included within the dividend allowance.

- The next £27,000 of dividends are taxed at 7.5% (basic rate) = £2,025.

- The remaining £45,060 dividends are taxed at 32.5% (higher rate) = £14,644.50.

- The total dividend tax liability is £16,669.50 (compared to £12,276.88 in 2015/16)

The additional dividend tax to pay = £4,392.62

—

The information provided in this blog and all our blogs is of a general nature. It is not a substitute for specific advice in your own circumstances. This information can only provide an overview of the regulations in force at the date of publication, and no action should be taken without consulting detailed legislation or seeking professional advice.

We can help look at your own personal circumstances, so why not contact us today?